Design Innovations Fuel Advancements of Next-Gen Diagnostic Wearables

The COVID-19 pandemic has been a harsh taskmaster, schooling virtually everyone with indelible lessons about the undeniable value of virtual consultations, medical monitoring and home testing. As a result, the market for diagnostic wearables is gaining momentum while continuing to evolve rapidly, especially in the areas of redefining various applications for remote monitoring and self-diagnosis.

According to Vision Research Reports, the global market for wearable medical devices is expected to reach $196.5 billion by 2030, growing from $21.5 billion in 2021, at a CAGR of 28%. The soaring demand for high-tech products and continuous health monitoring is fueling the market growth.

Wearable technology has gained steady traction, with fitness tracking, performance monitoring and heart-rate tracking applications gaining permanence in daily lives. Over the past two years, however, the future of medical monitoring came into clearer focus as a convergence between medical device companies and tech innovators altered the diagnostic wearables landscape.

Moreover, a steady emergence of new applications is creating new requirements for design engineers who must fully understand the wide-ranging needs of all stakeholders. This enlightened perspective will affect decisions across the entire product lifecycle—from early-stage device design concepts and usability studies to commercialization at scale, and every step in between.

Exciting Opportunities for Designers

The rapid growth in diagnostic wearables is creating exciting opportunities, especially for designers who are on the front lines of devising and delivering the next generation of products and services. Alongside the opportunities, however, are a multitude of complex design challenges.

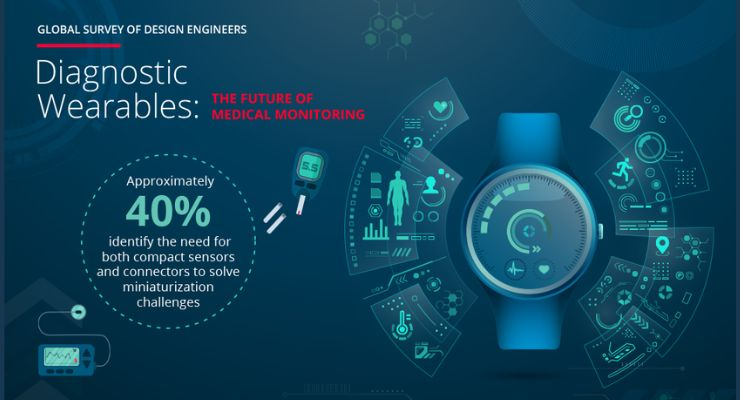

Identifying the major market drivers guiding the development of diagnostic wearables is crucial, as it impacts how patients, caregivers and consumers monitor and analyze data regarding health status. To that end, Molex and Avnet commissioned a survey, called “Diagnostic Wearables: The Future of Medical Monitoring,” to gain insights on how this industry segment is expanding and unfolding.

Some 600 design engineers and engineering managers from around the globe were queried on a range of questions. Overall, the responses showcased a strong sense of optimism, especially from designers in the ranks of startups and technology companies. Respondents broadly agreed that the technology is ready and barriers to innovation can be overcome—it’s just a matter of time.

According to the survey, leading the way for design challenges are consumer expectations for ease of use (42%), the need for simple user interfaces and complete documentation (41%), design difficulties in uncontrolled homecare settings (40%) and complexity of regulatory approval processes (34%).

In addition, factors that could impede design processes also include cost (38%), durability (37%), power (35%), miniaturization (33%), data capture (30%) and connectivity (30%). Issues with connectivity could emerge as the largest challenge as three in four respondents revealed that constraints could negatively impact the ability to collect relevant data for tracking and analyzing health.

Of particular interest, survey respondents have high expectations for use cases in three categories:

- Fitness (e.g., activity and heart rate tracking, performance monitoring)

- Wellness (e.g., sleep tracking, sun exposure, weight monitoring)

- Medical (e.g., monitoring of vital signs and glucose levels, remote EEG/ECG/EMG)

Looking for the silver lining in the COVID cloud, the entire world was given an education on the value of wearables during the pandemic. The reality and validity of at-home testing, remote monitoring and virtual consultations forced everyone to think about healthcare in different ways. Rewritten boundaries emerged in the survey, revealing that 80% of the design professionals saw a change in attitudes in the wake of the pandemic.

Sixty-one percent said they believe medical device companies are applying increased efforts in their home-based products—and roughly half said they saw greater interest in these products from patients, caregivers and other medical professionals.

A Growing Roster of Advocates

According to the survey, there also is good news in the growing roster of advocates who are encouraging adoption of diagnostic wearables. The impetus is led by patients and consumers (61%), along with doctors and other medical professionals (47%) as well as in-home caregivers (44%). Unsurprisingly, insurance providers, some doctors and other medical professionals, as well as medical technicians, remain hesitant or object to increased use.

It was no surprise that design professionals who responded to the survey felt that insurance companies—those that would pay the tab for these advancements—were the most hesitant to embrace wearable diagnostics (31%) and therefore are most likely to impede progress. While it is understandable that a certain contingent will always be cautious about new and emerging solutions, there was almost an equal number of respondents who felt insurance companies could be advocates. Perhaps this harkens the potential for innovations gaining a faster foothold in healthcare.

Nevertheless, as with any new development in the medtech space, gaining regulatory approval is always a challenging hurdle. That was the No. 1 impediment to adoption considered by nearly half of the survey respondents. Ensuring data integrity of the information garnered from existing wellness and fitness trackers ranked second on the list of challenges.

Where Will the Innovation Come From?

Understanding demand for wearable diagnostics is growing, so where will the innovation come from? Fifty-one percent of the respondents cited tech companies while 48% named medical device startups as the two groups most likely to take the lead over the next five years. However, almost two-thirds of the survey respondents believed collaboration from multiple groups is critical for achieving the most advancements across the sector. The importance of cross-industry cooperation and collaboration cannot be overstated as it is imperative for mutually beneficial parties to join forces.

Skeptics need look no further than the collaboration between SOTECH Health and Phillips-Medisize to recognize the fruits of good work between a medtech startup and established manufacturing solutions provider. In a show of further collaboration, the two companies leveraged research from The University of Texas at Dallas to create a breath analyzer that detects COVID.

An escalating pace of innovative collaborations is expected to come from industry, government and academic groups, according to 63% of the respondents. More thought provoking, however, were the findings that while nearly three quarters of respondents from China ranked group collaboration as the highest in importance, the U.S. came in at 61% while participants from Germany (59%), France (57%) and the United Kingdom (52%) followed.

Look for Consumers to Push for Progress

While insurance companies’ willingness to pay reimbursement costs will remain a looming determinant in the fate of many promising new medtech products, look for consumers to continue to push for progress. More and more products, such as wellness trackers and self-administered diagnostics, continue to gain popularity via the over-the-counter designation.

Many of these consumer offerings enjoy the advantages associated with well-established platforms, such as smartphones, tablets or watches, while others like Fitbit, favor a new hardware platform, which most likely will expand their capabilities in coming years.

Designers recognize consumer goods as a promising landing spot for their innovative products. The survey showed that more than 50% of the respondents agreed that applications such as obesity control, posture sensing and correction, breath-based disease detection, reproductive health monitoring and infectious disease monitoring showed intriguing promise.

Consumers’ acceptance of new diagnostic wearables is not a given, however. Key to gaining popularity, according to respondents, is ease of use (noted by 42%). Following just a point behind is the necessity for the user interface and documentation to be complete and simple.

A Market Ripe with Opportunities

The number of emerging applications for wearable diagnostics is extensive. While diabetes testing was most frequently mentioned by survey takers, mobile CT scanning, hazardous exposure sensing and mood monitoring show life-changing promise.

Overall, the survey paints a positive picture. As the applications for wearable diagnostics continue to expand—and as more stakeholders become comfortable using these technologies—this marketplace is ripe with opportunities for innovative designers and engineers to drive widespread acceptance for a new generation of wearable devices.

Article Source: Medical Design & Outsourcing