Five Breakthrough Medical Technologies Set to Transform Patient Care in 2024

Fig. 1 – Global PFA market value.

A new report from Clarivate Plc, London, UK, offers a predictive analysis of high-growth medical technology markets poised to generate over $1 billion in value or achieve double-digit growth within the next five years. The report, “Medical Technologies to Watch in 2024” underscores critical areas of significant investment. Medtech analysts pinpoint five technologies driving substantial clinical and commercial value in devices and diagnostics this year. These innovations hold immense promise for patients, potentially complementing or even supplanting traditional medications and biochemical solutions. Analysts are optimistic that 2024 will bring a more favorable economic climate for medtech competitors, noting that the macro trends remain positive.

“Despite the challenges of the past five years, the medtech industry has shown remarkable resilience, driving forward with groundbreaking technological advancements,” says April Chan-Tsui, director, medtech insights, life sciences & healthcare at Clarivate. “Backed by in-depth industry expertise and robust data, this report highlights recent breakthroughs poised to significantly improve patient outcomes. These innovations represent the forefront of medtech’s journey towards extraordinary impact.”

The five 2024 medical technologies to watch are pulsed field ablation devices, diabetes care devices, neurostimulation devices, surgical robotics, and renal denervation.

Pulsed field ablation devices. Pulsed field ablation (PFA) has emerged as a promising treatment for atrial fibrillation (AF), garnering significant attention from the cardiac ablation community. PFA employs electric pulses, not heat, that help in the electroporation of the myocardium without collateral damage to normal heart tissue. Compared to established treatment options, PFA has remarkably low recurrence rates, shorter treatment durations and higher success rates.

The PFA market, projected to reach $3 billion by 2028, is highly lucrative, especially considering the potential global population of 60 million individuals with AF (see Figure 1).

Diabetes care devices. Diabetes care technology is poised for significant growth in the near future, driven by ongoing advancements. Beyond these developments, significant activity is also under way in developing alternative treatment options for diabetes management, including new drug therapies and medical procedures that could potentially impact the growth of the diabetes care technology market in the coming years.

A potential hurdle for long-term adoption of diabetes care technology is the recent rise of GLP-1 receptor agonists (GLP-1 RAs), due to their demonstrated efficacy in blood sugar control in individuals with type 2 diabetes. However, due to the high relative penetration for insulin pumps in the type 1 diabetic population, GLP-1s are not expected to have a paradigmatically strong effect on the insulin pump market in the short term.

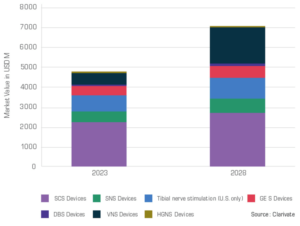

Neurostimulation devices. The multibillion-dollar implantable neurostimulation device market will grow as new and incumbent competitors expand treatable indications and launch new devices with design and lifespan improvements. The hypoglossal nerve stimulation device (HGNS) market has, in particular, witnessed rapid growth, and it is expected to surpass most other neurostimulation device markets in size in upcoming years.

The indications treated by neurostimulation devices — for example, chronic pain, epilepsy, and incontinence — can have a significant impact on a patient’s lifestyle and quality of life, and neurostimulation devices represent an important option for those who have not found sufficient efficacy in other treatments.

Surgical robotics. Surgical robotic systems are revolutionizing the field of medicine, offering better visualization, increased precision, and better ergonomics for surgeons. These systems go beyond simple robotic systems, providing a platform for minimally invasive surgeries with benefits for both surgeons and patients. Despite being considered innovative technology, robotics has become increasingly common; in the orthopedics space, for example, all major companies now offer a robotic system and have had to do so to remain competitive against their leading peers.

There is still significant room for expansion as the use of surgical robotic systems remains underpenetrated. Favorable leasing terms for robotic systems coupled with faster recovery times for minimally invasive procedures performed using these systems have increased their adoption in the ASC setting, opening a new avenue for revenue generation.

Renal denervation. The hypertension management market will regain its momentum with the dawn of the long-awaited age of renal denervation (RDN) technology. 2023 was eventful with the U.S. approvals of devices from Recor Medical and Medtronic poised to impact the hypertension management market in 2024 and beyond

Fig. 2 – Neurostimulation device market, U.S. and Europe 2023 and 2028.

Compared to the drug treatment of hypertension, RDN offers a one-and-done treatment of hypertension, with the demonstrated blood pressure reduction on top of the anti-hypertensive drug-induced blood pressure drop. The durable nature of the treatment outcome — demonstrated up to three years post-treatment — makes this an attractive treatment option not just for patients with uncontrolled hypertension, but also for patients with a preference for a nonmedication route (see Figure 2).

Methodology

To identify this year’s “Medical Technologies to Watch,” Clarivate drew from the expertise of over 40 analysts, covering over 80 medical device markets across more than 50 countries globally, and integrated medtech intelligence datasets that span the R&D and commercialization life cycle, along with other industry sources, including company press releases, financial filings, and peer-reviewed publications. Clarivate proprietary data and solutions used include Medtech 360, commercial targeting (Procedure Finder/Healthbase), tracking tools (Marketrack/PriceTrack), and Cortellis Competitive Intelligence™ and Cortellis Deals Intelligence™ and other real-world data analyses, including claims data and government data analytics.

Clarivate analysts used the company’s Data Explorer application to highlight markets that have a total forecast market value of more than $1 billion or more by 2028 or have rapid growth rates with high market values. The firm’s experts and analysts evaluated each medical technology in its individual context based on factors such as expected device approval or launch dates, reimbursement potential, competitive landscape, regulatory status, trial results, market dynamics, and other key factors.

Conclusion

Exciting technologies are emerging in the medtech sector, but the industry faces challenges including shifting service sites in the critical U.S. market, global supply chain disruptions, the rise of GLP-1 receptor agonists, the emergence of artificial intelligence/machine learning, and the fast-changing policy landscape. These challenges will be addressed in part two of the “Medtech Trends to Watch” report.

Article source: Medical Design Briefs