Why V-Wave’s heart failure tech is worth $1.7B to Johnson & Johnson

Cardiac implant developer V-Wave has a deal to be acquired by Johnson & Johnson for $600 million upfront, plus up to $1.1 billion in additional payments based on regulatory and commercial milestones.

V-Wave designed its Ventura interatrial shunt for minimally invasive implantation in patients with heart failure with reduced ejection fraction (HFrEF).

The company announced FDA breakthrough device designation for heart failure in August 2019 and then a second breakthrough designation for pulmonary arterial hypertension the following month. A CE mark for Ventura followed in 2020.

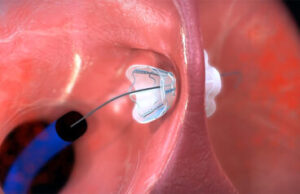

The V-Wave Ventura interatrial shunt being placed inside a patient’s hear. [Image courtesy of V-Wave]

Johnson & Johnson started investing in V-Wave in 2016. Announcing its plan to acquire the company, J&J said the Ventura implant “has the potential to fill a significant treatment gap between guideline directed medical therapies (GDMT) as a first line therapy and highly invasive cardiac replacement therapies, including left ventricular assist devices (LVADs) and heart transplantation.”

The technology “addresses an unmet need for approximately 800,000 patients who experience HFrEF in the U.S every year, representing a market opportunity for significant sustainable growth and meaningful impact,” the company continued.

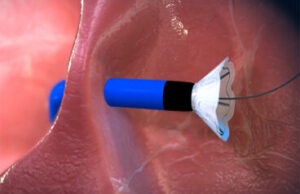

The V-Wave Ventura interatrial shunt’s nitinol frame allows it to collapse down for minimally invasive catheter delivery inside a patient’s heart. [Image courtesy of V-Wave]

How the Ventura interatrial shunt works

Using catheter access to the right side of the heart via the femoral artery, the catheter crosses the wall between the heart’s left and atrium (transseptal catheterization) and places the Ventura implant across the interatrial septum.

Guidance during the procedure is provided by fluoroscopy and echocardiographic imaging: transesophageal echocardiography (TEE) and/or intracardiac echocardiography (ICE).

The Ventura shunt has a nitinol hourglass frame to anchor it to the patient’s fossa ovalis and prevent embolization. The nitinol frame (and that nickel-titanium alloy’s superelastic properties) allows the device to compress down for catheter delivery and then expand when it emerges from the introducer sheath inside the patient’s heart.

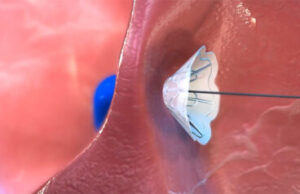

The V-Wave Ventura implant’s nitinol frame self-expands when it emerges from the introducer sheath. [Image courtesy of V-Wave]

V-Wave says the shunt’s novel hourglass shape is “engineered to create a venturi tube-like effect from the high-pressure atrium to the low-pressure atrium. This effect increases the efficiency of blood transfer, permitting a smaller size shunt.”

Another key material in the Ventura shunt is expanded polytetrafluoroethylene (ePTFE), which encapsulates the device in an effort to limit tissue growth and prevent blockages.

The first generation of the Ventura interatrial shunt had a one-way, bioprosthetic valve, but the latest design eliminated that valve to avoid lumen diameter narrowing or blockage, according to studies funded by V-Wave and published in JACC: Cardiovascular Interventions and EuroIntervention.

The V-Wave Ventura expands for anchoring to the patient’s fossa ovalis. [Image courtesy of V-Wave]

What’s next for V-Wave

It’s not clear when V-Wave will seek or win FDA approval for the Ventura implant.

Its RELIEVE-HF pivotal trial of patients with advanced heart failure (HF) and any left ventricular ejection fraction (LVEF) who were at high risk for cardiovascular morbidity and mortality events hit its primary safety endpoint, but did not demonstrate shunt-related benefit across the study population, which included HFrEF patients as well as patients with heart failure with preserved ejection fraction (HFpEF).

“Shunt implantation in HFrEF patients was associated with a 45% decrease in cardiovascular events including death, need for LVAD implantation or heart transplantation, recurrent HF hospitalizations, and worsening outpatient HF events (P<0.0001), indicating that these results are unlikely to be due to chance,” the company said when announcing results of the study in April 2024. “Favorable trends were seen for each of these cardiovascular event types, led by a 52% reduction in hospitalizations for HF. In contrast, shunt implantation in HFpEF patients was associated with an increase in these cardiovascular events.”

That study “showed impressive results with interatrial shunting in patients with HFrEF but also definitively showed that this is not the right treatment for those who had HFpEF,” said Dr. Gregg Stone, one of the study’s principal investigators, calling the data “groundbreaking for the field of heart failure.”

The V-Wave Ventura interatrial shunt with a dime for scale [Image courtesy of V-Wave]

The acquisition is expected to close by the end of 2024, with V-Wave joining Johnson & Johnson MedTech’s Cardiovascular portfolio. J&J Medtech Heart Recovery & Intravascular Lithotripsy President Michael Bodner will oversee the V-Wave team.

V-Wave CEO Dr. Neal Eigler said in today’s J&J news release announcing the deal that he’s “confident that Johnson & Johnson MedTech is well-positioned to ensure V-Wave’s breakthrough ideas and technology reach patients in need as quickly and effectively as possible.”

“I couldn’t be prouder of the V-Wave team, and the commitment it has taken to achieve this milestone,” he continued. “We look forward to continuing to build a world where cardiovascular disease is prevented, treated, and cured.”

Article source: MedicalDesign&Outsourcing