Another Defining Moment for Minimally Invasive Glaucoma Surgery

iStar Medical just left its mark on the fast-growing market for minimally invasive glaucoma surgery (MIGS).

The Wavre, Belgium-based company now has CE mark to launch its MINIject glaucoma implant in Europe. iStar said MINIject is now the only commercially available minimally invasive supraciliary device for glaucoma, meaning it is the only approved MIGS device designed to target the supraciliary space as a natural outflow pathway for the reduction of intra-ocular pressure (IOP).

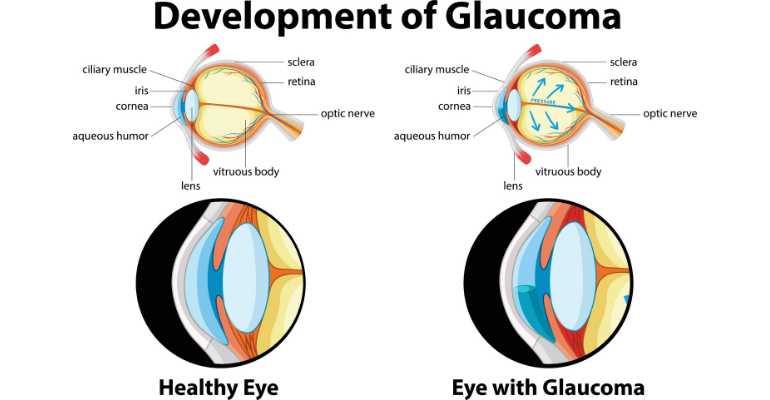

Glaucoma continues to be the leading cause of irreversible blindness, and is estimated to affect about 100 million people worldwide. With all types of glaucoma, the nerve connecting the eye to the brain is damaged, usually due to high eye pressure. According to the Mayo Clinic, the most common type of glaucoma (open-angle glaucoma) often has no symptoms other than slow vision loss. Angle-closure glaucoma, although rare, is a medical emergency and its symptoms include eye pain with nausea and sudden visual disturbance.

The diagram below shows the development of glaucoma.

According to iStar, MIGS represents the most promising and fastest-growing glaucoma therapy, due to its enhanced safety profile compared to traditional surgery. Right now, the MIGS market is estimated to reach about $786 million by 2026, according to report from MarketWatch.

Data reported to date by iStar across four trials in more than 150 patients consistently show that MINIject demonstrates a balance of powerful and sustained IOP reduction with a positive safety profile. The company also touts that MINIject’s efficacy and safety profile make the implant optimal for treatment in a broader glaucoma population.

The company is already rolling out the device in select European regions, and the first commercial implantations have already taken place in Germany.

“I’m very pleased that I’m now able to offer the MINIject supraciliary device as a treatment option to my mild-to-moderate glaucoma patients, the first of which was treated successfully today,” said Burkhard Dick, head of the ophthalmology department at the University Eye Hospital in Bochum, Germany. “Based on results so far, MINIject may open up new treatment paradigms for patients with glaucoma across Europe.”

As MD+DI reported last year, strong one-year results from the company’s STAR-II European trial were presented at the 2020 meeting of the American Academy of Ophthalmology (AAO). More recently, positive two-year results from the trial were presented at this year’s AAO meeting, demonstrating a sustained powerful efficacy and safety outcome in patients with open-angle glaucoma.

MINIject is currently being investigated in STAR-V, a pivotal study, which FDA gave its blessing for in July. The study is expected to enroll more than 350 patients with primary open-angle glaucoma.

“The launch of our first product in Europe sets iStar Medical on a very promising trajectory for future value generation,” said David Stocker, vice president of sales and marketing at iStar. “With its unique product characteristics, MINIject has the potential to gain a significant share of the growing wider market for glaucoma treatments, and amongst its peers in the MIGS segment. Our ambition is to make this novel MIGS solution available to a broad patient community and grow the organization, our network, and our international footprint to meet the size of the opportunity.”

Moments that defined the minimally invasive glaucoma surgery market

The MIGS market has undergone many significant changes in recent history, and there are more changes on the horizon that will further define the space. At one point, six stand-alone companies were competing in MIGS, but many of those original players have either been acquired or dropped out of the race due to product failures.

• One MIGS OG that continues to dominate the space is Glaukos. The San Clemente, CA-based company has been at the forefront of the MIGS market for several years now, and was the first to gain FDA approval in the space. Glaukos was also the first MIGS company to go public back in 2015, raising $140 million in its initial public offering.

Another leading contender in the space is Ivantis. The Irvine, CA-based received FDA approval for its Hydrus Microstent in August 2018, marking another defining moment for MIGS. The Hydrus Microstent is used to treat patients with mild to moderate primary open-angle glaucoma in conjunction with cataract surgery. Glaukos and Ivantis recently settled a patent lawsuit, which will have Ivantis paying Glaukos $60 million, plus a 10% ongoing royalty through April 26, 2025.

• The original six stand-alone MIGS players became a group of five after Dublin, Ireland-based Allergan bought AqueSys in 2015 for $300 million plus milestone payments. That deal was the first time a large public company made a move in the space, but it certainly wouldn’t be the last. In 2016, Osaka, Japan-based Santen Pharmaceuticals acquired Innfocus for $225 million. That was the third such merger in the space, which left Glaukos, Ivantis and iStar as the only three stand-alone MIGS players.

• Alcon pulled its Cypass Micro-Stent off the global market in 2018 due to patients experiencing statistically significant endothelial cell loss compared to patients who underwent cataract surgery alone. Alcon, which was part of Novartis at the time, acquired the CyPass Micro-Stent when it bought Transcend Medical in 2016. The CyPass product removal caused shares to skyrocket for Glaukos, and created distance between the other MIGS firms. It looks as though Alcon will be getting back into MIGS soon though. The Geneva, Switzerland-based company recently announced its inentions to acquire Ivantis for $475 million.

• We’d be remiss not to mention Sight Sciences, which is also eyeing a strong position in the stand-alone MIGS market, and has the data to back that up. A study, showing two-year outcomes of the Menlo Park, CA-based company’s Omni Surgical System, was published in Clinical Ophthalmology earlier this year.

Article source: Qmed and MD+DI